By Wang Cong

US and some other Western firms’ reported request for the US to impose a staggering 920-percent duty on Chinese graphite is reckless, as the move, targeting another globally leading Chinese industry, could potentially inflict huge damage on the US’ electric vehicle (EV) sector and its consumers, an industry analyst said on Thursday.

Bloomberg reported on Wednesday that a trade association filed petitions with two US federal agencies on Tuesday asking for investigations into whether Chinese companies are violating anti-dumping laws and hoping to trigger punitive tariffs of as much as 920 percent on Chinese graphite in response.

The petition was filed by the American Active Anode Material Producers (AAAMP), a group of US and Canadian graphite producers. Meanwhile, Australian graphite firm Novonix also said that it has joined the petition, and another Australian firm Syrah Resources said its unit, Syrah Technologies LLC, filed an anti-dumping and countervailing duty petition with the US Department of Commerce and the International Trade Commission, Reuters reported on Thursday.

“This is yet another crackdown attempt from the US and some of its allies against a leading Chinese industry. It is reckless because such a request completely disregards the potentially huge damage this could have on the US’ own EV industry and consumers,” Wu Chenhui, an independent analyst who closely follows the critical minerals industry, told the Global Times on Thursday.

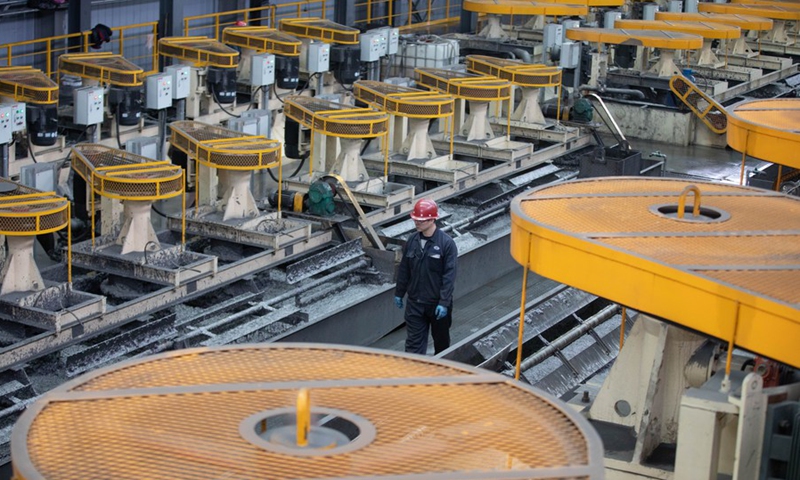

Wu noted that China’s graphite industry is so much ahead of the graphite industries in the US and some of its allies that companies in these countries cannot compete with their Chinese counterparts, so they are resorting to protectionist actions and attempts to contain their Chinese competitors.

A report from Oxford Economics, which appears to be supporting North America’s graphite growth, said that in 2023, China supplied 92 percent of the graphite anode material used in batteries.

The latest petition in the US for higher tariffs on Chinese graphite came after the US government in 2018 already imposed a 25-percent duty on Chinese synthetic graphite. In addition, Canada plans to impose tariffs on a slew of Chinese products as early as next year, with levies on semiconductors, permanent magnets, and natural graphite following in 2026, Reuters reported on Tuesday. In October, the European Commission also announced so-called anti-dumping probes into certain graphite electrode systems and artificial graphite in blocks or cylinders from China.

Notably, China has also strengthened export controls on graphite. In October 2023, the General Administration of Customs (GAC) and Ministry of Commerce jointly announced export controls on certain kinds of graphite items to protect national security and interests. The export controls took effect on December 1, 2023. A MOFCOM spokesperson said in January that the move is not a ban and is aimed at fulfilling international non-proliferation obligations and safeguarding China’s national security and interests.

Following the export control measures, relevant graphite exports to the US have been declining. China’s exports of natural flake graphite, which falls under the export control, to the US dropped by about 39 percent to about $3.95 million in the first 10 months of 2024, compared to $6.48 million during the same period in 2023, according to GAC data.

Meanwhile, despite the US government and some firms’ push for production of graphite in the US from the US government and certain firms, some EV makers, including Tesla, have struggled to find reliable sources of graphite outside of China and have applied for exemptions from the current 25-percent tariff, according to the Bloomberg report. In an application for the US Trade Representative’s office, Tesla said “there is no single manufacturer outside of China that currently meets Tesla’s specifications and additional capacity requirements.”

“Any additional tariffs on Chinese graphite will increase costs for production of batteries and EVs, which will in turn increase prices for US consumers,” Zhang Xiang, chief energy storage expert at Jiangsu Gufeng Electric Power Technology Co, told the Global Times on Thursday. “Graphite producers in the US are aiming to take advantage of the US’ containment strategy against China to bolster their business. But this would be a lose-lose move.”