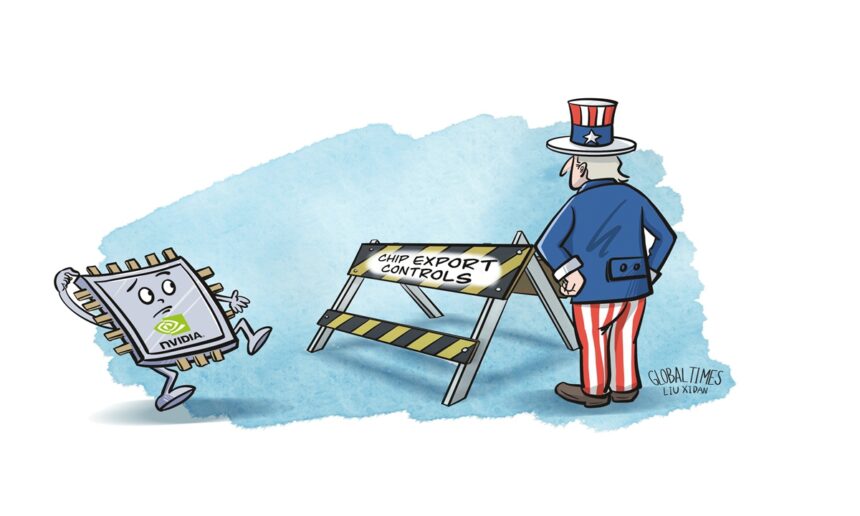

US Commerce Secretary Howard Lutnick said on Tuesday that the Trump administration is seeking help from companies and foreign governments to prevent China from getting US chips, and it plans to try to bring export controls into trade deals, Reuters reported. This strategy, however, may prove to do no good to US companies. Efforts to weave export controls into trade agreements could potentially undermine the overall competitiveness of American exports.

In recent years, the US has increasingly misused export control measures. A notable instance, as reported by Reuters on January 13, involves the US government’s decision to further restrict artificial intelligence (AI) chip and technology exports. A spokesperson from China’s Ministry of Commerce said that the US government’s abuse of export control measures severely hinders normal economic and trade exchanges between countries, and severely damages the interests of enterprises worldwide, including those in the US.

To grasp the impact of the misuse of export controls on American manufacturers, it is essential to first analyze the structure of the US manufacturing sector. Historically, American manufacturing was robust, but it began to decline after the 1980s, leading to industrial hollowing-out, particularly in labor-intensive industries. However, it’s important to recognize that the US has maintained a strong capability in research and development within the manufacturing sector. Especially in the high-end segments of the manufacturing supply chain – many of which are knowledge-intensive industries – the US often holds a competitive edge.

This dynamic has ongoing implications for the evolution of the US manufacturing export structure. As a developed nation with relatively high labor costs, the US faces considerable challenges in positioning itself as a major exporter of labor-intensive products such as toys. Instead, the country’s manufacturing export strengths are more concentrated in medium- to high-end and cutting-edge sectors – including vehicles, auto parts and semiconductors.

Developing nations like China are making rapid strides in these manufacturing areas, especially in components for electric vehicles and their batteries, fueling intense global competition. To maintain and enhance its competitive advantage in manufacturing exports, the US needs to further elevate its production to the higher end and boost exports in cutting-edge manufacturing sectors such as high-tech products and high-end chips. This approach not only capitalizes on the strengths of the US manufacturing industry but also meets significant demand in the international market, presenting ample opportunities for export expansion.

Regrettably, in recent years, the US has been overstretching the concept of national security, politicizing trade and tech issues, and abusing export controls. This approach has restricted its own exports, particularly in sectors where the US holds a competitive edge on the global stage. Such policies could impede the progression of the US manufacturing export structure toward more sophisticated markets, a strategy that could have bolstered American exports in facing intense global competition, ultimately affecting the overall competitiveness of American exports.

The US trade deficit in goods hit a record $1.2 trillion last year, as American consumers snapped up imported products and a strong US dollar weighed on export growth, the New York Times reported. In addressing this widening deficit, leveraging tariffs to curb imports has been shown by some studies to have multiple adverse effects on the US economy. A more economically sound strategy would be to truly capitalize on the competitive advantages of US exports, aiming to expand them further. This approach not only aligns with economic rationale but also offers a sustainable path to mitigating the trade imbalance.

Regrettably, Lutnick’s remarks suggest that the US may persist in its misuse of export controls, potentially entrenching and institutionalizing these measures by incorporating them into trade agreements. This effort is likely to result in a lose-lose situation: further curbing US exports of high-end chips while simultaneously reducing the global supply of these chips, creating voids in the global market and further disrupting global supply chains.

This scenario could pose challenges to the global semiconductor supply chain, but within these challenges lie opportunities. Many countries, including China, are striving to accelerate the development of their semiconductor industries and advance toward high-end chip production. The market space relinquished by US chips due to Washington’s misuse of export controls encourages global chip manufacturers to continuously evolve toward more advanced technologies.