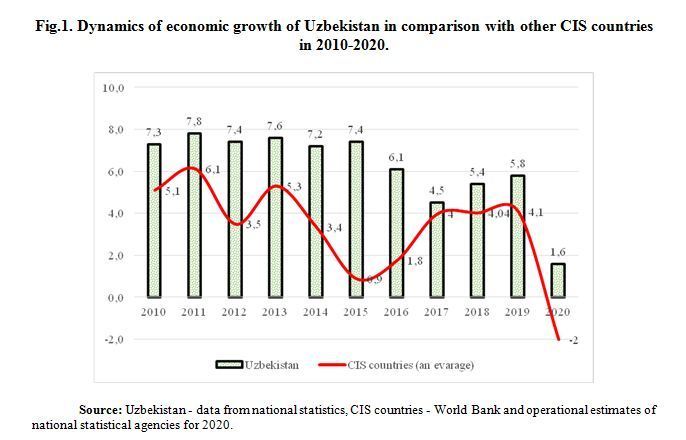

New priorities for reforming the economy of Uzbekistan. Uzbekistan is one of the few countries in the world with a fast-growing economy. Over the last decade, the Republic’s GDP growth rate has been steadily exceeding the average rate for the group of leading CIS countries (Russia, Kazakhstan, Belarus) and several countries of the Central Asian region (Kyrgyzstan, Tajikistan). Even during the pandemic crisis of 2020, when these countries recorded a decline in the economy (with the exception of Tajikistan), Uzbekistan managed to maintain positive economic growth (Fig. 1).

Fig.1. Dynamics of economic growth of Uzbekistan in comparison with other CIS countries in 2010-2020.

Source: Uzbekistan – data from national statistics, CIS countries – World Bank and operational estimates of national statistical agencies for 2020.

From the perspective of qualitative changes and conditions of development three sub-periods should be distinguished: preservation of the growth model that existed until 2010 (2010-2016); acceleration of the economic reforms process (2017-2019); development in a pandemic crisis (2020). For the first sub-period, the average annual GDP growth rate was 7.2%, the second 5.2%, and the third 1.6%.

The reform process, which began in 2017, was aimed at activating new factors of economic growth – improving the investment climate, expanding export potential, intensifying foreign trade, strengthening macroeconomic stability. Significant milestones in this path were the liberalization of the foreign exchange market, visa simplification, the transition to a flat income tax scale of 12%[1], reducing a number of administrative costs of doing business, opening branches of some famous foreign universities of Korea, Russia and the United States. With the participation of foreign experts in 2017 alone, 18 free economic zones and 77 small industrial zones, as well as 10 technoparks were established in the country, which contributed to the accelerated development of the regions of the republic[2].

In the sphere of foreign economic policy, the list of products banned for export was significantly limited, the requirement for mandatory sale of foreign currency earnings was abolished, import customs duty rates were significantly reduced, procedures for the preparation and implementation of export contracts were simplified, additional conditions for the export of fresh fruit and vegetables were created.

Corruption poses a serious threat to the successful reform of the economies of the developing countries. Realizing the need for qualitative changes in the economy and the creation of a favorable environment for business, the government has sharply intensified the fight against corruption over the past three years. Already in 2017, the Law of the Republic of Uzbekistan “On Combating Corruption” was adopted. The next step in this direction was the Roadmap for the implementation of measures to reduce the share of the shadow economy. Its initial stages became universal introduction of digital technologies and marking in branches and sectors of economy, 211 kinds of state services were rendered through a single portal of state services, since January 1, 2021 70 of 266 kinds of licenses and 35 of 140 licenses were cancelled, time for registration of 14 kinds of licensing activity and permission documents was reduced by almost twice, the procedure for obtaining 115 licenses and permission documents is simplified, the volume of non-cash payments in economy was increased, large-scale propaganda work on intolerant attitude to all kinds of corruption was organized.

In order to coordinate the efforts of various agencies and public organizations in this area, the Anti-Corruption Agency was organized in mid-2020. In total, from 2017 to the end of 2020, 17 normative acts were adopted in the field of combating corruption, reforming the state apparatus, financial control, strengthening parliamentary control, and reforming customs regulations[3].

As a result of all these efforts, over the past two years, 1986 officials who illegally caused 2 trillion soums of damage to the state have been prosecuted for corruption-related crimes.[4] During this period, 371 billion soums of budget funds were embezzled throughout the republic. 2477 persons were held criminally liable for these crimes.

In the first 9 months of 2020 alone, 838 criminal cases involving corruption were opened. Four officials at the republican level, 15 at the regional level and 626 at the city and district levels were prosecuted. The law enforcement agencies instituted 838 criminal proceedings for corruption, of which 647 officials were prosecuted in 454 criminal cases. Damage from corruption offenses of officials in the nine months amounted to more than 200 billion soums. Compared to 2019, the number of criminal cases filed in 2020 increased by 15.5%, the number of officials prosecuted increased by 28.7%.

Starting from 2021, the results of the rating will be published annually to evaluate the personal responsibility of regional and government leaders in the fight against corruption and the shadow economy. A methodology for calculating the rating of corruption and the shadow economy for government agencies, enterprises and regions has been developed. Beginning in 2021, the results of this rating will be announced annually, assessing the personal responsibility of managers of all levels and ranks.

Liberalization of the economy, proclaimed as the most important priority of the new leadership of the country, is impossible without a profound modernization of the system of economic management. Its main priorities – reducing the scale of direct government regulation through the transition to the principles of indicative planning, forecasting and economic programming, reducing spending on the state apparatus, optimizing the structure of public administration, improving the efficiency of functioning.

In this connection, the economic management system has undergone significant changes. The National Project Management Agency was created to increase the level of consistency in the process of economic reforms and to introduce modern information management systems. In accordance with the presidential decree in 2019, the Ministry of Investment and Foreign Trade, responsible for implementing a unified state investment policy, coordinating the attraction of foreign investment, cooperation with international financial institutions and foreign government financial organizations, as well as the formation and coordination of a unified state policy in the field of foreign trade, international economic cooperation, was formed.

To improve the level of coordination of projects and programs, their conformity with the national interests, the state authorities have adopted the “Strategy of actions in the five priority areas of development of the Republic of Uzbekistan in 2017-2021”, approved by the Decree of the President of the Republic of Uzbekistan of February 7, 2017[5].

Over the past four years, a large number of regulatory documents have been adopted, including the Concept of administrative reform, decisions to strengthen personnel policy, executive discipline, to improve the accessibility of public services, the introduction of the digital economy, the development of public-private partnerships.[6].

If until 2017 there were no documents of strategic nature in the sphere of public administration and, respectively, regulation was carried out in the mode of annual planning and budgeting, only in the last 2 years such important documents as “National goals and objectives for sustainable development until 2030”, “Strategy for the transition to a “green economy in 2019-2030”, “Environmental Protection Concept until 2030”, “Agriculture Development Strategy for 2020-2030” were adopted. These documents give clear guidelines to business about the long-term priorities of the government, create the necessary prerequisites for modernizing the management system, expanding the use of indirect economic regulators and transferring it to the principles of indicative planning.

The results of the measures taken to modernize the economic management system should have a positive impact on the competencies of public service employees, efficiency in implementing government decisions, limit the vulnerability of the civil service to political pressure, expand the ability to manage political change without drastic policy changes or interruptions in public service delivery, the ability to reconcile conflicting goals into coherent policies, and ensure effective revenue mobilization and budget management.

All of these characteristics are at the heart of the Government Effectiveness Index, compiled by World Bank analysts [7]. An analysis of the dynamics of this index over the past 20 years (see Fig. 2) compared to the average estimates for the developing world shows that since 2012 there has been some progress in the dynamics of this indicator. However, the gap with the developing countries of the world is still significant, the country is only at the beginning of the process of modernizing the system of economic management.

Figure 2. Dynamics of the Government Effectiveness Index for the period 2000-2019 in comparison with the average estimates for the totality of the developing countries of the world

Source: Authors’ calculations based on World Bank estimates.

Due to the coronavirus epidemic, some businesses have been given tax vacations and a number of inefficient budgetary and quasi-budgetary expenditures have been reduced. There is hope that after the epidemic it will be possible to consolidate some positive steps towards reducing government involvement in the economy.

The level of macroeconomic stability achieved. These and other changes in the regulatory and legal framework, economic reforms, and improvement of the management system in recent years have been reflected in structural and qualitative shifts. First of all, there has been an upward trend in the structure of the economy since 2017, with the share of industry rising to nearly 30% of GDP in 2019 (see Figure 3), up from 23.3% in 2014, reflecting the implementation of targeted development programs for various industries adopted since 2014 (see below).

At the same time, there was a moderate decline in the share of agriculture, from 33.3% in 2014.[8], to 28.2% in 2020, which reflected the process of optimization of cultivated areas, the flow of population to urban agglomerations, the creation of new forms of agriculture (clusters, multipurpose farms, see below).

On the whole, these two industries have accounted for between 54% and 57% of total GDP in recent years, which indicates the preservation of the industrial-agrarian orientation of the national economy, established since the early 1990s.

Fig.3. Structural shifts in the real sector of the economy over the period 2010-2020.

Source: State Statistics Committee, Central Bank, World Bank estimates

The level of diversification of the economy, the ability to provide the population with new sustainable jobs largely depends on the scale of development of the manufacturing sector of industry. The sector’s share in the volume of industrial production has not changed dramatically in the last 10 years (see Fig. 2, right-hand side). Its slight growth from 75.4% in 2010 to 81.8% in 2016 was replaced by some decrease to 78.5% in 2020. This demonstrates the remaining reserves for deepening the processing of the rich natural and mineral resources that the republic possesses, and the need to use them as soon as possible through the introduction of new innovative and digital technologies.

In recent years, there has been no noticeable progress in expanding the medium- and high-tech sector (production of computers, optical equipment, electrical engineering, other machines and mechanisms). The share of this sector in the volume of industrial production had an unstable dynamics, varying from 12% to 16.4%. This indicates that the investment factor in the development of this sector, by itself, does not provide the necessary guarantees of achieving sustainable results. It is necessary to create all necessary macroeconomic and institutional prerequisites for development of this most promising sector for the republic, including modern infrastructure and mechanisms of accumulation of national professional competences, creation of modern scientific, technological and design base for development of new economic sectors, sharp increase in the quality of technical education, creation of modern logistical and marketing systems for promotion of these products in foreign markets. Important prerequisites are also reduction of corruption and shadow economy, provision of property guarantees to investors and businessmen, the necessary level of macroeconomic stability.

The acceleration of economic liberalization, which began in 2017, was reflected in the growth of investment and foreign economic activity. However, the liberalization of the foreign exchange market and the subsequent devaluation of the national currency became one of the main factors of increasing risks to macroeconomic stability. While in 2010 the GDP deflator did not exceed 10%, already in 2017 its value rose to almost 20%, and in 2018 the increase in prices for the economy as a whole was 27%, with its subsequent reduction to 19% in 2019 and 11% in 2020.

Price growth occurred against the backdrop of almost two-fold devaluation of the national currency in 2017 (from almost 4,000 soums per dollar to 8,000 soums) with high devaluation rates continuing in subsequent years – 28% in 2018, 9.5% in 2019 and 13.4% in 2020 (year-on-year using average monthly exchange rate estimates for the year). Given the large share of imported products in the consumption of households and intermediate consumption of the real sector, this devaluation could not but lead to an acceleration of price growth.

The growth of investment activity manifested itself starting from 2018, when the value of gross investment rose to 30.6% of GDP (against an average of 21.4% in 2010-2017), with a subsequent increase to 37.1% in 2019 and 34.8% in 2020 (see Fig. 3, left part). (preliminary estimate – see Fig. 3 left side).

At the same time, the level of monetization (the ratio of broad money M2 to GDP) of the economy remained at a low level, significantly below the world average estimates for the developing world (from 50% to 100%), which made it difficult for the national banking sector to credit investment projects. As a result, foreign lending became the main source of financing, which led to a rapid growth of external debt (left side of Fig. 4).

Fig. 4. Dynamics of indicators of investment and foreign economic activity in 2010-2020.

Source: Data of the State Statistics Committee of the Republic of Uzbekistan

Analysis of key macroeconomic indicators over the past 10-15 years shows that there is a limit to investment growth, determined by the assets and other capabilities of the financial sector, large enterprises, and household incomes, exceeding which can destabilize the economic situation. In 2011-2016, investment was at multi-year levels (21-23% to GDP), and external debt grew slightly (7.5%-14.6% to GDP). The investment boom of 2017-2020 led to a rapid growth of total external debt up to 46% of GDP (according to preliminary estimates for 2020), due to increased external borrowing for construction and other capital-intensive industries, weakly related to both resource saving and green development.

The same situation is also inherent in foreign trade. Exceeding the investment threshold, as well as the large-scale insufficiently thought-out liberalization of foreign trade changed the ratio between exports and imports. While in 2011-2016 the foreign trade balance was active (average estimate +1.6% of GDP), in the last 4 years it has become deficit and increased to minus 10-12% of GDP in 2018-2020. (Fig.3 right-hand side).

High risks for macroeconomic stability are also carries a significant level of capital intensity of economic growth. While in 2000-2005 each sum of investment (in the current year and in two preceding years with weights of 0.7, 0.2 and 0.1, respectively) exceeded 7 sum of GDP (in 2010 prices), by 2010 this indicator went down to 4 sum. The rapid growth of investments in 2018-2020 has further reduced the return on capital (to 3.4 soums in 2018 and 2.5 soums in 2020, a preliminary estimate). Thus, the return on investment has fallen almost three (3) times since the early 2000s.

As calculations show, maintaining capital productivity at the level of 2.5 soums of GDP/1 soums of investment will aggravate the macroeconomic situation. Maintaining economic growth even at the level of 3-4% per year in 2021-2025 in conditions of low capital productivity will require the volume of investment (40-41% of GDP), significantly higher than the threshold value (21-23% of GDP). In this case the dynamics of external debt will intensify and may reach 45-50% already in the coming years with a growing impact on the growth of the state budget deficit due to increasing interest payments on debt servicing, increasing the risks of accelerating depreciation of the national currency and limiting the possibility of taking large-scale measures to combat poverty.

The high rates of depreciation of the national currency in relation to the growth of the economy and the population had a negative impact on the position of the republic in the international ratings on the criterion of the level of development. While back in 2015-2016 the GDP per capita exceeded $2,000. GDP per capita exceeded $2,000, in 2018 it fell to $1,532, and has remained at a low level for the last two years ($1,725 and $1,763 in 2020, preliminary estimate). This situation jeopardizes the achievement of the often proclaimed goal of taking the country out of the 40 poorest countries of the world and into the group of countries with an above-average level of development (with GDP per capita above about $5,000) in the context of high population growth rates and increasing risks and barriers to development (climatic, pandemic, conjunctural, etc.).

There is a need for a critical review of established principles and approaches to economic reform – the dominance in economic policy of standard recommendations of international organizations on mass privatization and accelerated liberalization of the economy as the main factors to improve its competitiveness and solve social problems, the use of the GDP indicator as the main criterion of success, etc. There is a need for a transition to a new economic model, focused primarily on domestic sources of development, resource saving, increasing the contribution of economic growth in solving social problems, including the fight against poverty and the shadow economy, reducing the burden on natural capital, the revision of criteria for the success of economic reform.

The new model should create conditions for solving the following economic problems and areas of development.

New industrialization, economic diversification and expansion of sustainable employment in the industrial sectors of the economy. Beginning in the second half of 2016, Uzbekistan’s industrial policy was focused on strategic objectives for the development of the industrial sector of the economy, related to accelerating the modernization and diversification of industries and ensuring the rapid development of high-tech manufacturing enterprises, primarily those producing finished products with high added value based on the deep processing of local raw materials.

Over the 2016-2019 period, the nation’s industry grew at an average annual growth rate of 107.2%, with cumulative growth of 124.3%. The difficult conditions of 2020 caused by the coronavirus epidemic and the resulting quarantine and closure of borders and disruption of logistical links led to a slowdown and, in the months when strict quarantine measures were introduced, a drop in production not only in industry in general, but also in certain sectors of the manufacturing industry. Production fell particularly sharply between January and December 2020 in the mining and quarrying industry (78.1%), which was largely due to reduced economic activity and demand from China and other external consumers of natural gas. As a result, natural gas production for the reporting period was, which was 17.8% lower than the corresponding period last year. Also, production in water supply, sewerage, waste collection and disposal (92.1%) did not reach the level of 2019.

The sharp decline in external demand for natural gas in 2020 due to the global production crisis caused by the coronavirus pandemic, as well as domestic factors lagging natural gas reserves growth due to investment constraints, were the main reason for the decline in mining production (down 20.7 percent compared to 2019).

The level of competitiveness increased significantly in the production of textile products and clothing, an industry with great potential for the creation of new sustainable jobs. Thus, at the end of the difficult year of 2020, the export of textiles and textile products increased most noticeably compared to the previous year (by 118.1%). At the same time, the share of industry products in total exports increased over the year from 9.3% to 12.7%, and the share of finished products with high added value in total industry exports reached 32.4% against 16.1% in 2016.

At the same time, the low share of medium- and high-tech products in industrial output, including production of devices and equipment required for resource saving, and the ambiguous dynamics of this indicator (Fig. 2) raises the question of accelerating the development of this sector, developing our own technologies with international cooperation, such as breakthrough technologies in RES and pharmaceuticals, to borrowing and adapting foreign developments, including technologies of deep processing of raw materials with a complete cycle (creating materials with new materials and technologies for the production of energy resources).

The new industrial policy should be aimed at in-depth processing of raw materials and digitalization of industries and enterprises, transition to a new technological mode with a focus on the introduction of less energy-intensive “green technologies”, formation of resource-saving technological platforms for the development of basic industries, taking into account the expected increase in the effectiveness of the implementation of industry development programs and strategic directions of the “green” economy.

As the results of the adopted industry programs increase, the industry may receive additional development impulses due to faster digital transformation of production facilities and achievement of green development priorities. According to some estimates, the implementation of digital systems will achieve a 20% increase in productivity, depending on the industry, at existing facilities, as well as increase the output of finished products by 5-10%.

In general, the effect of the digitalization of industries, combined with the introduction of technologies for deep processing of raw materials, successful localization of advanced technologies and managerial competencies in mechanical engineering, further development of pharmaceutical technologies, commercialization of RES technologies, will be to achieve progressive technological shifts and growth of sustainable employment in industrial production. In this case, the investment policy, more focused on stimulating the implementation of investment projects aimed at the process of “closing” the gap in the added value chains to a greater extent, will contribute to positive technological shifts with a growing share of medium and high-tech industries.

Growth of agricultural productivity, food security, reduction of pressure on natural capital. Thanks to structural reforms and the implementation of measures to support sustainable development and modernization of the agricultural sector, gross agricultural output grew by almost 7.2% in 2016-2020. The average annual growth rate of agricultural, forestry and fishery production during the analyzed period was about 2.6%.

In recent years, attention has been paid to the transformation of farms into multi-profile farms. Multi-productivity along with crop cultivation allows one to engage in processing, storage and sale, as well as the provision of any services and other types of activity not prohibited by law. Multipurpose farms from the moment of inclusion in a special register are for 5 years exempt from payment of the single tax on all types of activities not related to crop growing.

Uzbekistan occupies a leading position in the world for the production and export of a number of crops. For example, in production of apricots our country takes the 2nd place among 71 producing countries, carrots – 2nd place among 137 countries, quinces – 3rd place among 56 countries, cherries – 3rd place among 70 countries and others. Fresh apricots exports ranked Uzbekistan 5th out of 88 exporting countries, persimmons 4th out of 79 countries, dried apricots 4th out of 91 countries and raw silk 4th out of 34 countries.

In 2019, the “Strategy of agricultural development of the Republic of Uzbekistan for 2020-2030” was approved, which covers the following strategic priorities: ensuring food security of the population; creating a favourable agribusiness climate and value chains; reducing the role of the state in the management of the sphere and increasing investment attractiveness; ensuring rational use of natural resources and environmental protection; development of modern public administration systems; gradual diversification of public spending in support of the sector; development of science, education, information and advisory services in agriculture; development of rural areas; development of a transparent system of sectoral statistics.

The cluster system is actively developing. Until 2020, 73 cotton-textile clusters were formed in Uzbekistan, and in 2019 their share was 73% of the grown cotton crop. The average yield in them was 0.41 tons per hectare higher than in non-cluster lands.

As of October 15, 2019, state regulation of flour prices, which had been in place since 1994, was stopped in Uzbekistan. The sale of flour at market prices ensures effective allocation of resources and competition in the markets, taking into account the interests of both producers and consumers. This mechanism increases the interest of flour mills and provides them with the financial capacity to modernize production facilities, which will serve to improve the quality, increase the volume of products and increase labour productivity.

Beginning with the 2020 harvest, the state grain order will be reduced by 25%, and beginning with the 2021 harvest the practice of the state establishing grain procurement prices and state purchases will be completely abolished. The fund of state support of agriculture on the basis of futures and forward contracts or through exchange trades at a free price will purchase grain in the amount necessary to implement measures to ensure price stability for grain and bread products in the domestic market.

Starting with the 2020 harvest, the practice of setting purchase prices for raw cotton is also abolished and raw cotton producers (farms, cotton-textile clusters, and cooperatives) are granted the right to free varietal placement of seasoned cotton. Mechanization of the industry, which replaces manual labour, is also being actively pursued in cotton growing.

Since September 2020, the mechanism of subletting agricultural land for the purpose of growing agricultural products was introduced.

Uzbekistan is an active participant in the implementation of international agreements in the field of prevention and adaptation to adverse climate change (Paris Agreement 2015, Aral Sea agreements, etc.). In 2019, Uzbekistan continued intensive reforms of legislation and strategic frameworks, including in the field of the environment. A number of long-term strategic documents were adopted this year, such as the Environmental Protection Concept until 2030, the Strategy for the Transition to a Green Economy for 2019-2030, the Strategy for Solid Waste Management for 2019-2028, and the Strategy for Biodiversity Conservation for 2019-2028.

The share of environmental protection expenditures as a percentage of GDP in 2012-2019 was very low – about 0.02%. These figures are extremely low, especially given the environmental problems faced by the country.

Uzbekistan is making significant efforts to increase the forest area through reforestation and afforestation. Between 2010 and 2018, forest-covered areas increased from 6.63% to 7.26% of the country. More and more land plots are transferred to the category of lands of the state forest fund as lands potentially suitable for forestry.

Labour market. The labour market of the republic is one of the most important factors of economic growth. Its distinctive feature is the high proportion of young people. The population between the ages of 18 and 39 make up 59% of the total employed population. This category of the employed is concentrated mainly in the service sector (financial sector, health care, social services, trade), which suffered most significantly during the quarantine restrictions (the share of the sector in the GDP structure is more than 35%).

Another peculiarity is the high share of labour resources in the informal sector of the economy. It employs about 8 million people, or about 60% of the total number of employed in the country.

The unemployment rate (excluding labour migration) for 9 months of 2020 is about 11.1% of the economically active population. The unemployment rate among young people (aged 16-30 years) is 17.1%, among women – 14.7%[9].

A significant flow of labour migration is also a feature of the current state of the labour market in Uzbekistan. The number of labour migrants is about 2.5 million people or about 19% of the total number of those employed in the economy. In case of mass return of labour migrants, it will complicate the already tense situation in the labour markets.

The government has adopted several support packages. If at first it was a question of how and when to stop quarantine, now the question is how to distribute the growing economic losses from the impact of crisis phenomena. The principle of state support has evolved from indirect support measures in the form of exemptions and deferrals of taxes and payments to partially direct support in the form of exemptions and write-offs of taxes and payments.

During the first two months of the quarantine alone, 12 presidential decrees and resolutions were adopted to mitigate the impact of the pandemic on living standards and industries, amounting to nearly 30 trillion soums[10] or 5.9% of GDP.

Most of the anti-crisis measures taken in the area of employment preservation were aimed

- at supporting entrepreneurs by:

- deferral of payments on certain taxes, bank loans and rent payments for small businesses and households;

- reduced tax deductions, reduced tax rates and preferential loans;

- exemptions for small businesses from payment of certain taxes, rents;

- certain penalties and interest payments on loan servicing

- elimination of certain bureaucratic barriers for small businesses and the population.

As a result, as shown by the preliminary results of 2020, it was possible not only to prevent a major decline in the services sector, but despite the compression of demand for tourism, transportation, trade and intermediary and some other types of services, in general, to maintain the volume of services provided at the level of 2019.

Regulation of labour migration. Uzbekistan, a country with a rapidly growing population, is one of the main suppliers of labour resources to the world labour markets. According to some estimates, 4 to 5 million citizens of the republic work outside the country. Beginning in 2016, the state began to increase its attention and changed its approach to migration in the republic. By 2020, Uzbekistan has created a system for professional and language training of migrants, including 191 centers. In addition, there are 136 institutions for training professions in mahallas. The courses there are designed for 1, 3 or 6 months. The choice of profession is based on demand. Mahalla centers train in sewing, computer literacy, hairdressing and cooking.

It should be noted that migrants working abroad are equated to the self-employed. They have the opportunity to pay social tax, which is 50% of the basic calculation value – 111.5 thousand UZS. It is absolutely voluntary payment, which gives him the opportunity to count this period in the length of service with a pension in the future.

In conclusion, it should be noted that in the search for a new model of economic development the republic has come a long way in a short time, having made significant breakthroughs in various areas of reform and liberalization of the national economy since 2017. Over the past three years, the position of the republic in such international indices as the Doing Business index, the Global Innovation Index, Index of Economic Freedom, The Global Competitiveness Index, Corruption Perception Index, etc.

Unlike the vast majority of countries in the world during the difficult period of the pandemic crisis, Uzbekistan managed to maintain the positive dynamics of economic growth and prevent a large-scale increase in unemployment.

Relationships with neighbors have been improved and foreign trade with many countries has intensified, helped by the liberalization of the foreign exchange market and the reduction of barriers to foreign trade. These changes have increased exports from $12.1 billion in 2016 to $17.4 billion in 2019.

The level of competitiveness in the industries with the highest export potential increased significantly. Thus, according to the results of the difficult year of 2020, the export of textiles and textile products increased most noticeably compared to the previous year (by 118.1%), and the industry’s share in total exports increased from 9.3% to 12.7% during the year.

Qualitative changes are also taking place in agriculture. The cluster system is actively developing. Until 2020, 73 cotton-textile clusters were formed in Uzbekistan, and in 2019 their share was 73% of the grown cotton crop. Their average yield was 0.41 tons per hectare higher than that of non-cluster lands.

Chepel S.V., D.Sc. in Economics, chief scientist of the Project

Sadriddinov Nuriddin, Acting Head of the Project

[1] Other changes in the tax system – a radical reduction of taxes on labor (1.5-2 times), a significant reduction of the tax burden on large enterprises, including the reduction of the VAT rate from 20 to 15%, the elimination of deductions to the State trust funds from revenues, a significant reduction of the sphere of influence of taxes on turnover.

[2] https://stat.uz/images/uploads/docs/eiz_dek_2020_ru.pdf

[3] The Law of the Republic of Uzbekistan “On Combating Corruption”. (NO. ZRU-419 ON 03.01.2017); The Decree of the President of the Republic of Uzbekistan “On Measures to Implement the Provisions of the Law of the Republic of Uzbekistan “On Combating Corruption”. (№PP-2752 02.02.2017); The Decree of the President of the Republic of Uzbekistan “On Approval of the Concept of Administrative Reform in the Republic of Uzbekistan” (№UP-5185 on 08.09.2017); Decree of the Cabinet of Ministers of the Republic of Uzbekistan “On Approval of the Regulation on the Main Department of State Financial Control of the Ministry of Finance of the Republic of Uzbekistan” No. 870 on 24.10.2017), etc. ( https://lex.uz/docs)

[4] https://anticorruption.uz/ru/item/2020/12/23/korruptsiyaga-qarshi-kurash-strategik-yondashuvni-talab-etadi

[5] Electronic source http://www.lex.uz/docs/3107042

[6] Decree of the President of the Republic of Uzbekistan “On Approval of the Concept of Administrative Reform in the Republic of Uzbekistan” №UP-5185 on 08.09.2017; Decree of the President of the Republic of Uzbekistan “On Measures to Further Strengthen Executive Discipline in State Bodies and Organizations” № PP-3962 on 05.10. 2018; Decree of the President of the Republic of Uzbekistan “On Additional Measures to Ensure Further Economic Development and Increase the Efficiency of Economic Policy” No. UP-5614 on 08.01.2019; Decree of the President of the Republic of Uzbekistan “On Additional Measures to Improve the Training, Retraining and Professional Development of Managerial Personnel at the Academy of Public Administration under the President of the Republic of Uzbekistan” No. PP-4365 on 27.06.2019, etc.

[7] : http://info.worldbank.org/governance/wgi/

[8] The low estimates of the share of agriculture before 2014 (2010-2013, 17-17. 5%) are explained by the recalculation and refinement of GDP indicators according to the new methodology performed by the Statistical Committee in 2018 for all its accounts for the period from 2014 to 2017.

[9] Source: Republican Scientific Center for Employment and Labor Protection of the Ministry of Employment and Labor Relations. http://centr-truda.uz/2020/11/16/uroven-bezraboticy-v-uzbekistane-snizilsya-s-132-do-111/

[10] Source: Video conference call chaired by the President of the Republic of Uzbekistan on May 19, 2020, on additional measures to support entrepreneurship and the population.