The US federal budget deficit grew to $1.833 trillion for the 2024 fiscal year, which ended on September 30, the highest outside of the COVID-19 era, as interest on the federal debt exceeded $1 trillion for the first time, the Treasury Department said on Friday.

The $1.833 trillion budget gap was 6.4 percent of the US GDP, up from 6.2 percent a year earlier, Reuters reported on Saturday.

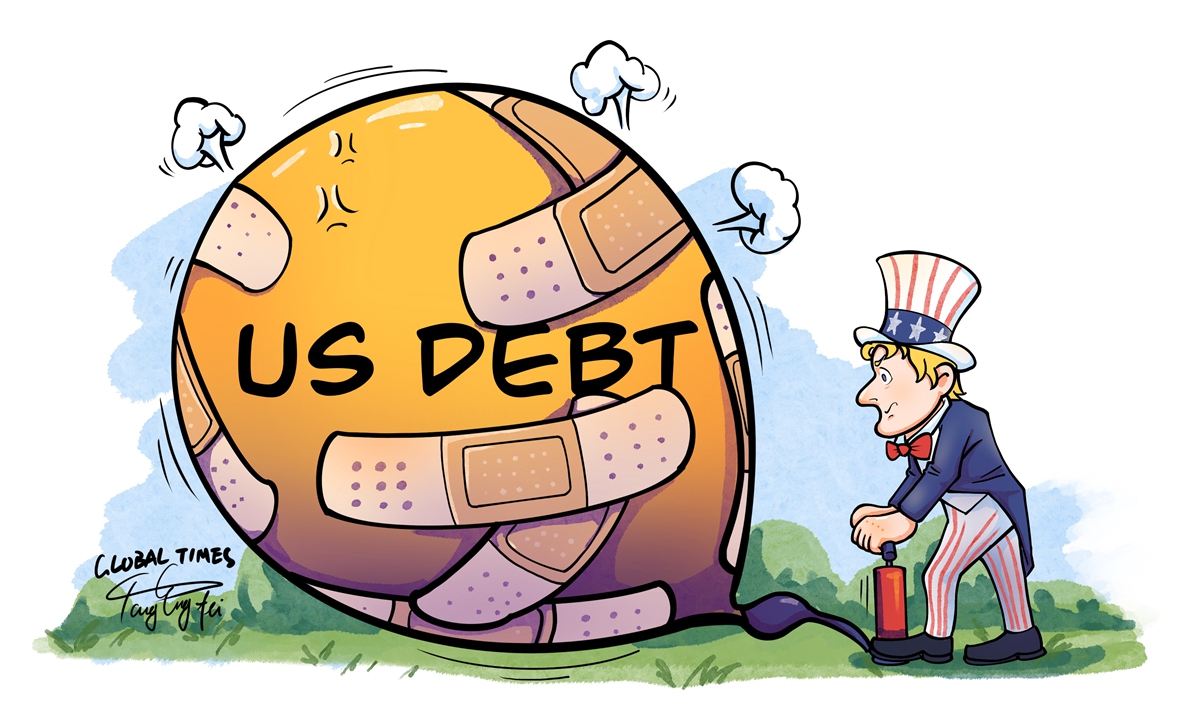

As the US federal government is grappling with total debt of more than $35 trillion and that amount is constantly reaching new highs, the unprecedented situation is causing widespread concerns across world financial markets. Elevated deficits and skyrocketing interest payments may evoke fears of an imminent fiscal crisis if appropriate counter-measures are not taken.

The biggest driver of this year’s deficit was a 29-percent increase in interest costs for US Treasury debt to $1.133 trillion due to a combination of higher interest rates and more debt to finance, Reuters said.

Additionally, the US government’s fiscal expenditures have remained highly elevated, with outsize investments in sectors like defense, health care and pensions for the aged, all of which continue to grow.

However, the growth rate of US tax revenue has lagged behind the growth rate of fiscal spending. The fact that yearly interest payments have exceeded the $1 trillion mark for the first time further highlights many of the problems and challenges facing the US economy, as well as the difficult-to-reverse US deficit. This severe situation is testing the country’s economic governance.

Warnings regarding the US fiscal imbalance and the unsustainable level of its debt have been generating concerns among US media outlets and think tanks, with some experts going so far as to label the situation the “ticking time bomb of US debt,” highlighting the urgent need for policy reforms and fiscal responsibility to avert a potential economic crisis that could have far-reaching implications for both domestic and global financial stability.

A potential acute American fiscal crisis would be a catastrophe not just for the US but also for the whole world. An explosive fiscal crisis in the US could have significant global repercussions, affecting many economies in different ways.

While the immediate consequences of a fiscal crisis in the US would primarily affect the US itself, the interconnected nature of the global economy means that many other countries could also experience significant negative repercussions. Some emerging markets may be vulnerable, especially those with substantial exposure to US debt or those that depend heavily on US investment.

If the US debt level is perceived as unsustainable, it could trigger considerable shocks in international financial markets. Financial markets are highly sensitive to changes in perceived risks, and a sudden shift in sentiment regarding US debt could lead to increased volatility in stock, bond and commodity markets.

Concerns about the sustainability of US debt could result in a depreciation of the dollar, leading to volatility in foreign exchange markets. This would particularly affect countries that hold significant amounts of dollar-denominated assets. A weaker dollar could also alter global trade dynamics.

China’s monetary and fiscal policies have been prudent, providing ample room to address potential risks in the global financial markets. This policy orientation reflects China’s strong capability to respond to challenges in the global economic environment.

The country has the ability to ensure that the yuan fluctuates within a reasonable range by using effective policy tools and market measures, effectively mitigating uncertainties arising from potential spillover effects of fiscal risks in the US. This approach not only enhances international market confidence in the yuan but also offers Chinese importing and exporting enterprises stable expectations for international trade.

As a major manufacturing power in the world, China holds an indispensable and irreplaceable position in global supply chain cooperation. The diversity and resilience of its economic structure provide a strong support for its economic stability. By maintaining steady economic growth and a reasonable fiscal deficit, China can withstand external shocks.

The author is a reporter with the Global Times.bizopinion@globaltimes.com.cn