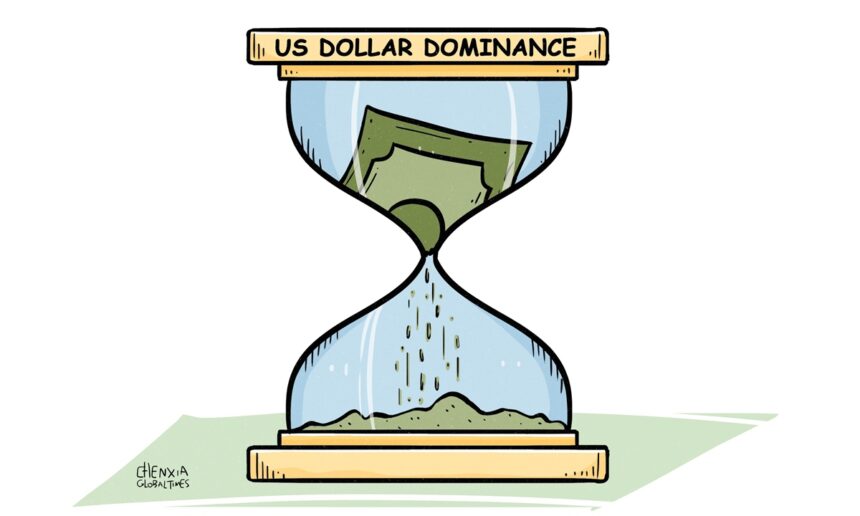

As the market faith that has long unconditionally backed the US dollar and Treasury bonds begins to wane, the halo of US Treasury debt as the risk-free asset is rapidly dissipating.

All three major Wall Street indexes on Wednesday closed with their biggest daily losses in a month, while the US dollar weakened against a range of currencies. The US Treasury Department on Wednesday auctioned off a $16 billion sale of 20-year bonds at a high yield of 5.047 percent, according to Reuters. The 30-year Treasury bond yield was up about 12 basis points to 5.09 percent, breaking above the key 5-percent level for the second time this week and reaching a level not seen since October 2023, CNBC reported.

All these signs point to a troubled market. Unlike in the past, these disturbances are not just short-term market fluctuations. They represent shaky confidence in the reliability of the US dollar and Treasury debt. For a long time, US Treasury bonds were regarded as one of the safest assets globally, a haven for investors during market turmoil. No matter how turbulent the global market became, the Treasury market could always attract a large influx of capital. However, this situation is undergoing a change, as the once-risk-free asset becomes a risk in itself.

A series of factors are eroding investor confidence in Treasury debt. Concerns about tax-cut policies, US tariff policies, debt issues, and soaring inflation expectations are all at play.

For starters, Moody’s downgrade of the US credit rating and market worries about the US tax-cut bill have shifted bond market investors’ attention to US fiscal problems. While tax cuts may stimulate economic growth in the short term, in the long run, they will only continue to widen the deficit.

Moreover, the US tariff policy is another major source of investor anxiety. By attempting to overturn the world economic order that has been in place for decades, the unilateral and protectionist US policies have escalated global trade tensions. This increases the risk of a US recession while plunging the global financial market into a state of high uncertainty.

The European Central Bank warned in its bi-annual Financial Stability Review on Wednesday that heightened investor concern over the riskiness of US assets following the US tariff drive could further jolt the world’s financial system. The “atypical shifts” away from traditional havens like the dollar and US Treasury bonds after April’s trade announcements may point to a “fundamental regime change.”

The total debt of the US federal government has exceeded $36 trillion, with $6.5 trillion in government bonds maturing in June this year alone, according to the Xinhua News Agency. Data from the US Treasury Department showed that the US budget deficit grew to more than $1.3 trillion in the first half of the 2025 fiscal year, the second-highest six-month deficit on record, according to the report. If the US fails to repay its debts on time or has to resort to excessive money printing to alleviate debt pressure, the value of US Treasury bonds will face market pressure and harsh scrutiny.

The sharp decline in the US Dollar Index highlights the erosion of dollar hegemony from another perspective. The dollar’s status as the world’s main reserve currency has long relied on the strong economic power of the US and its financial system. However, as US economic problems become more apparent, more and more countries are re-evaluating their holdings of dollar-denominated assets. This year, the US dollar index has depreciated by more than 7 percent, wiping out all its gains in 2024.

In addition, the interconnectedness of global markets means US economic tremors reverberate worldwide. Also on Wednesday, the yield on 30-year government debt in Japan, the largest foreign holder of US Treasury bonds, rose to 3.185 percent, a new record. Apparently, global financial markets’ concerns about US economic policies are intensifying. Such concerns not only undermine global investors’ confidence in the US dollar and Treasury bonds but also pose a threat to global financial stability.

Of course, the decline of dollar hegemony will be a long and tortuous process. But the current market volatility is by no means a mere short-term fluctuation in sentiment, but rather a profound manifestation of the ongoing erosion of the US dollar’s hegemonic status and a crisis of confidence in US Treasury debt. This turbulence has not only exposed the fragility of the credit foundation underlying US debt but also revealed the deep-seated challenges facing the dollar-dominated system. The emergence of the current signs may herald a progress toward a more decentralized, multipolar international financial order.