The US replaced the Chinese mainland as the top destination for Taiwan’s exports in the first quarter of this year for the first time since comparable data became available in 2016, the Chinese version of VOA reported on Friday.

The island of Taiwan exported $24.6 billion worth of goods to the US in the first three months of this year, while its exports to the Chinese mainland reached $22.4 billion, according to statistics from Taiwan authorities.

Although the comparison may suggest that the US has overtaken the Chinese mainland in terms of economic and trade significance for the island, the export figures alone do not accurately portray Taiwan’s overall trade relationships and economic conditions. Furthermore, relying solely on these figures as a justification for underestimating Taiwan’s dependence on the mainland would be misguided.

Ever since the start of cross-Straits economic and trade exchanges, the Taiwan island has maintained a huge trade surplus with the mainland, which has become the main support for the stable economic development of the island and an important source of momentum for its industrial transformation and upgrading.

Even though cross-Straits economic and trade relations have suffered in recent years due to factors such as US sanctions, restructuring of global industrial chains, and other geopolitical changes, the island still obtained more than $100 billion in trade surplus from the mainland on an annual basis.

According to Chinese mainland customs, the island of Taiwan exported $238 billion worth of goods to the mainland in 2022, resulting in a surplus of $156.51 billion. Exports fell by 15.4 percent year-on-year to $199.35 billion in 2023, but the island still maintained a trade surplus of $130.86 billion.

By comparison, the island’s trade surplus with the US hit $35.54 billion in 2023, up from $29.41 billion in 2022.

Although Taiwan’s exports rebounded strongly in the first quarter of this year, it was mainly attributed to the accelerated development of American artificial intelligence companies and the mainland’s economic recovery. However, export dependence on a single industry is fragile, especially given that global major economies are all vigorously developing their own chip industries.

It is true that Taiwan’s exports of semiconductors, electronic components and computer equipment to the US more than tripled from 2018 to reach nearly $37 billion in 2023. But what lies in the shadow of growing economic ties between the island of Taiwan and the US is a worrying trend of an industrial shift.

Chip giants like TSMC have set up factories in the US, and the Biden administration is trying its best to strengthen its own chip sector and build local chip production capacity. Once the industrial shift is completed, Taiwan’s exports to the US will be affected. An important reason for the US to force Taiwan companies to relocate its chip factories is to ensure that no one can any longer use chips to make big money from the US.

Also, Taiwan’s electronics exports to the mainland will decline due to the US “decoupling” push, leading to a trend of Chinese mainland chips replacing Taiwan chips.

Additionally, the island’s investment in the Chinese mainland dropped nearly 40 percent to $3 billion in 2023, while its investment in the US surged ninefold to $9.6 billion, according to Taiwan authorities.

This shift in investment is poised to significantly impact Taiwan’s economy, as the movement of capital signifies not only a financial shift, but also a loss of industry, technology and employment prospects.

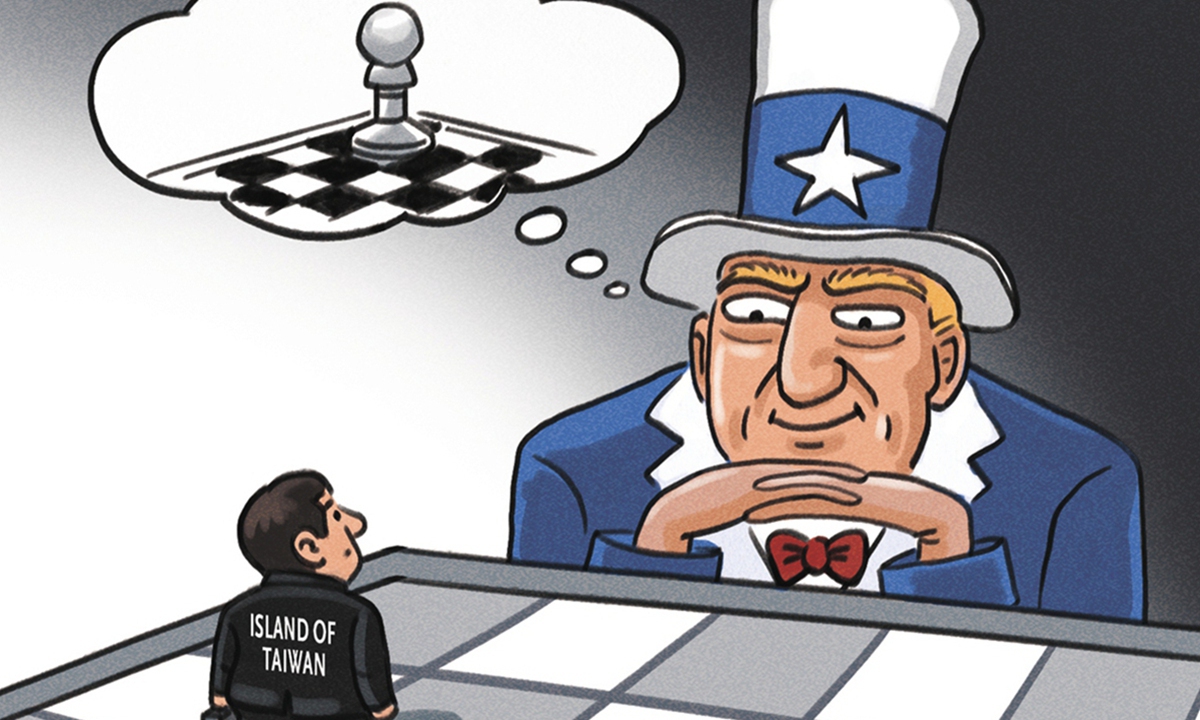

Therefore, Western hype about the close trade cooperation between the US and China’s Taiwan region cannot hide the challenges facing the island’s economy. It is hoped that the Taiwan authorities don’t lose out on the prospects of the island’s chip industry for short-term gains.

Last but not the least, Taiwan’s economic development will ultimately depend on the reunification of the motherland. As an inalienable part of China, the island of Taiwan cannot base its economic stability on the US.