The China Iron and Steel Association said that China’s steel production surpassed 350 million tons in the first quarter, a 6.1 percent year-on-year increase, China Central Television (CCTV) reported on Sunday. Despite facing external challenges, China’s steel industry has continued to focus on internal improvement and built a solid foundation for the wider manufacturing sector. This development stands in stark contrast to the US strategy of trying to revive its steel industry through the imposition of protectionist tariffs.

A 25 percent tariff on imports of steel and aluminum into the US came into effect in March, significantly disrupting the global supply chain. Facing external pressures, the Chinese steel industry did not halt its progress. Instead, it doubled down on technological innovation and low-carbon transformation, efforts aimed at fostering a more sustainable and competitive future. As of April 20, 141 steel companies had completed comprehensive ultra-low emission upgrades, covering steel capacity of approximately 591 million tons, CCTV reported.

Between 1949 and 2023, China’s steel production skyrocketed from 158,000 tons to an astonishing 1.019 billion tons. Since surpassing the 100-million-ton mark in 1996 and securing its position as the global leader in steel production, China has consistently remained at the forefront as both the largest producer and consumer of steel worldwide.

The country has experienced remarkable progress in the development of a wide range of high-quality, specialized steel products. This transition from manufacturing basic construction materials to producing advanced products like ultra-thin “hand-torn steel” and ultra-fine “pen tip steel” signifies a shift toward high-value, specialized products designed for a sophisticated and technologically advanced market.

While the US has been focusing on imposing tariffs to protect its outdated steel production capabilities, China’s steel industry has been consistently prioritizing technological innovation. This approach includes phasing out outdated capacity and making technological upgrades, which enhances the sector’s competitiveness and supports its sustainable, green and low-carbon development.

This year, the technological advancement involved in utilizing recycled steel materials instead of iron ore for production has shown significant results. This method can reduce carbon dioxide emissions by more than 67 percent compared with traditional iron smelting.

In China, there is a widely accepted belief that the greater the external pressure, the more we should concentrate on enhancing our internal strengths. Within this framework, external challenges often act as catalysts for further economic advancement. This is exemplified by the steel industry, which is fundamental to numerous manufacturing sectors. Continuous development and technological innovation in China’s steel industry, particularly in the production of high-end products, have established a robust foundation for the stable growth of the nation’s manufacturing sector amid a complex international landscape.

Against the backdrop of sluggish global economic growth and escalating trade tensions, the steel industry is facing increased uncertainty from external factors. Jiang Wei, secretary-general of the China Iron and Steel Association, told CCTV that the Chinese steel industry is countering this uncertainty with a focus on economic efficiency and high-quality development. This approach aims to ensure steady and continuous improvement within the industry despite external challenges.

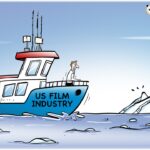

In contrast, the US appears to be taking a different path: in the midst of fierce competition in the international market, it is attempting to use tariffs as a means to provide a protective shield for its domestic steel industry. One potential outcome of these protectionist approach could be the preservation of outdated production capacity, leading to an increase in steel prices. This could ripple through to the broader manufacturing sector, affecting prices downstream.

“Tariffs are inherently inflationary and will drive up both domestic and imported steel prices,” Earl Simpkins, partner at PwC, told Reuters. Steel is widely used in a variety of manufactured products.

The differing efforts by the US and China in advancing the steel industry could have profound implications for the broader manufacturing sector downstream. Whether trade protectionism or technological innovation will emerge as the fundamental force driving the development of manufacturing remains to be seen. We believe that time will reveal the answer.