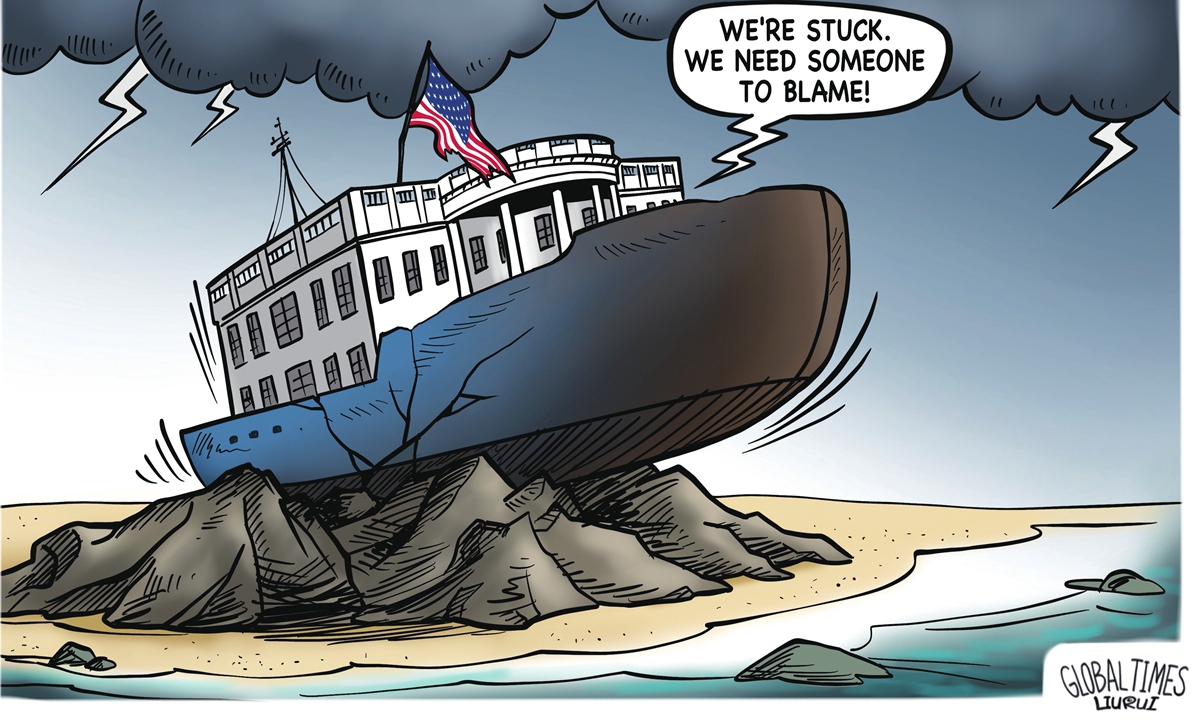

For US political elites, some of whom rashly advocate for economic “decoupling,” America’s shipbuilding industry should serve as a lesson. It demonstrates that revitalizing US manufacturing requires global cooperation and fair competition, rather than trade protectionism and geopolitical games.

America’s shipbuilding industry has virtually collapsed over the past generation, with years-long delays and cost overruns making it hard for the US Navy to build the ships and submarines it needs, Bloomberg reported on Saturday.

Against this backdrop, South Korean shipbuilder Hanwha Ocean is reportedly purchasing a former US Navy shipyard in Philadelphia and has recently secured South Korea’s first-ever contract to overhaul a US naval vessel. These steps pave the way for the company to play a larger role in the US naval shipbuilding sector and could herald the start of a new wave of investment, Bloomberg’s report said.

Regardless of whether “a new wave of investment” becomes reality or not, one thing is almost certain: The tide has gone out for US commercial shipbuilding.

In 1975, the US shipbuilding industry was ranked No.1 in terms of global capacity, with more than 70 commercial ships on order for production domestically. Nearly 50 years later, the US now produces less than 1 percent of the world’s commercial vessels, having fallen to 19th place globally, according to the Financial Times.

An interesting phenomenon is that the decline of America’s shipbuilding industry has been accompanied by protectionism. The US Congress passed laws reserving domestic waterborne trade to “qualified US vessels.” These laws, along with other measures, provide a protective umbrella for the country’s fragile shipbuilding industry.

In addition, some upstream industries, such as the steel sector, have benefited from trade protectionism. Over the past four years, the US imposed more than 30 anti-dumping and countervailing duties on steel-related products. As a result, domestically produced steel is less cost-effective than steel made in many other countries due to US trade protectionism. The high cost of steel in the US is one of the factors contributing to the decline of the country’s shipbuilding industry.

Protectionism has become a poison for the US shipbuilding industry. Such measures cannot boost the manufacturing sector. On the contrary, protectionism will only make domestic firms less competitive and ultimately impede output.

The decline of the US shipbuilding industry should serve as a tough lesson for the US economy.

To address the challenges facing this industry, the US may want to attract investment from allies, particularly South Korea and Japan. Some observers view these efforts as a step forward, indicating that the US is being compelled to open up its shipbuilding industry, at least to its allies. However, this is far from enough to revitalize the US shipbuilding sector.

Some Americans view the US shipbuilding industry through a geopolitical lens and are eager to hype the so-called China-US competition. They keep a close eye on China’s shipbuilding sector, and certain Western media outlets often hype the narrative of “China’s threat,” claiming that China had 1,749 large oceangoing commercial vessels under construction in its domestic shipyards at the beginning of 2023, while America had only five.

Such a comparison is meaningless and doesn’t contribute to the development of the US shipbuilding industry. Instead, it could undermine international cooperation.

Many people in Washington are still trapped in a zero-sum mindset. They need to break the shackles of their old ideas, abandon the “decoupling” approach as soon as possible and get mutually beneficial international cooperation back on the right track.