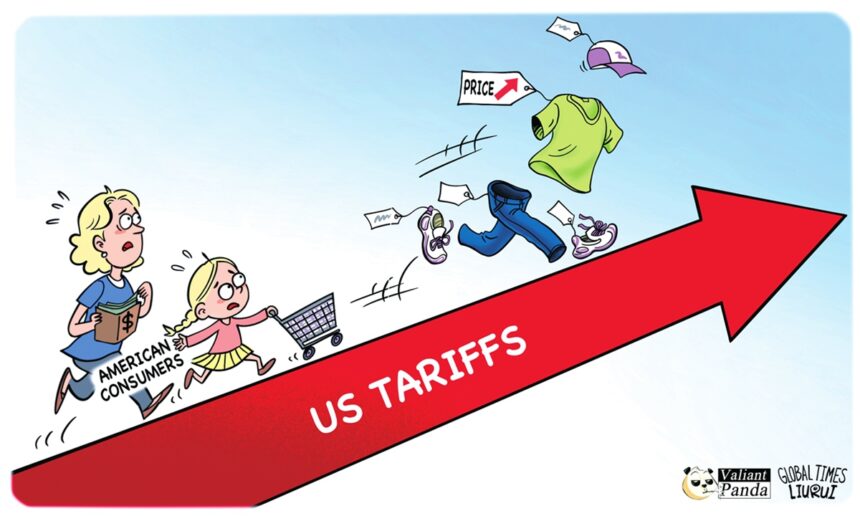

The Wall Street Journal (WSJ) published an article on Saturday, saying that the US additional tariffs imposed on Chinese imports are hurting US toy makers, who face higher costs and reduced assortment. This piece provides a detailed look into the complexities of trade and supply chain interactions between China and the US, highlighting how US tariffs are negatively impacting the American economy, especially the daily lives of Americans.

Citing data from the Toy Association, a leading industry group, CNN reported in April that nearly 80 percent of all toys sold in the US are manufactured in China. At that time, goods from China were facing tariffs at a whopping 145-percent rate. CNN noted the significant impact of these tariffs on the toy industry with a headline stating that “145-percent tariffs on China are clobbering the toy industry.”

Following the temporary rollback of some tariffs, the toy industry, among some others, has found a moment of relief. This development represents a positive step forward; however, according to the WSJ’s latest report, concerns over rising prices remain in the US. Businesses worry the tariff rates could go up further in August, when the 90-day period of reduced tariffs on China is set to come to an end.

Considering the public’s welfare, it becomes essential for the US to further lower these tariffs. Doing so would allow American families to access high-quality imported goods, such as dolls, at more affordable prices.

The US government may hope to reshore manufacturing through tariffs, but what are the actual outcomes? A report by Business Insider in May highlighted that even with massive tariffs on Chinese goods, it’s unlikely industries like toy manufacturing will be able to quickly scale up in the US. Jason Miller, a professor of supply chain management at Michigan State University, emphasized the complexity of this issue by noting that the ecosystem for toy production is in China, and “that ecosystem isn’t something that can up and move quickly,” according to Business Insider.

Over the past few decades, China’s toy industry has continuously developed, cultivating a wealth of expertise in production techniques and management practices. China has established toy industry clusters.

For instance, South China’s Guangdong Province is renowned for its plastic, electronic, and battery-operated toys, while certain cities in East China’s Jiangsu Province are famous for their plush toys. These clusters benefit from well-developed and mature supply chains, encompassing logistics, printing, packaging, and raw materials, which not only facilitate production but also lead to cost savings. In regions like the Pearl River Delta, the efficiency of these supply chains enabled some companies to achieve zero inventory for components and even raw materials years ago.

According to media reports, some Chinese toy manufacturers have embraced digital and smart production. For instance, in the production of universal building blocks, some companies have managed to keep the margin of error below 0.02 millimeters. High-tech products, such as electronic and voice-activated toys, which demand sophisticated technology, are often outsourced to Chinese firms by multinational corporations.

This trend is a natural outcome of the long-term evolution of the global industrial chain division of labor. Replicating such an extensive and mature industrial chain on a short-term basis presents significant challenges.

William Su, who sells tens of thousands of dolls and accessories a year to Americans, told the WSJ that for “some toys like dolls and doll strollers, we have no alternative other than China in 2025.”

If the demand for these items from US businessmen like William Su remains inflexible, tariffs are likely to be passed on to American consumers. Dolls are not the only products that highlight the inextricable trade ties between the two countries. From this perspective, further reducing tariffs on Chinese imports could benefit American consumers by making quality goods from China more affordable.