China’s export controls on gallium and germanium, two niche materials key to making semiconductors and other high-tech products, are set to take effect on Tuesday. Observers anticipate that this “first shot” may hit entities from countries that have cracked down on China, given that the move is meant to protect core national interests.

As to concerns over the Chinese government’s expanded controls on more vital materials such as rare earths, experts said that these foreign companies should ask their own governments to end unfair practices on Chinese companies, instead of meddling in China’s export rules, following Western countries’ blatant restrictions against China.

In a notice issued in early July, China’s Ministry of Commerce (MOFCOM) and General Administration of Customs said that exporters will be required to apply for permission before exporting items related to gallium and germanium, starting on Tuesday.

In the application, exporters must provide relevant export contracts, proof of the end users, as well as information on the importers and the end users.

It’s not an outright ban, but the first batch of entities that may be affected might be those from nations that have imposed similar curbs on China and harmed China’s core interests, said Ma Jihua, a veteran industry analyst.

For others, as long as the proposed uses are reasonable and the management is appropriate, there is no need to worry about the expansion of the controls, Ma told the Global Times on Monday.

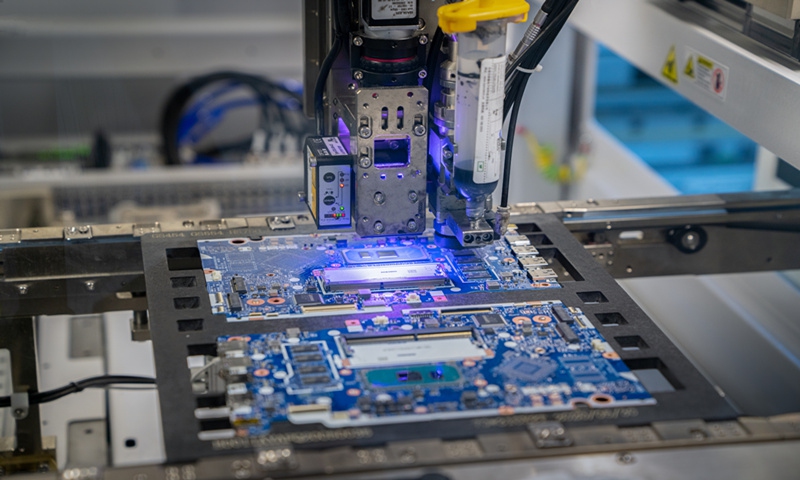

Both gallium and germanium are widely used in the manufacturing of chips, communication and defense equipment, and other high-tech components. Gallium, for example, is used in compound semiconductors, while germanium is widely used in fiber-optic communication and night-vision goggles. China is the top supplier of both materials, with exports of gallium accounting for 94 percent of global supply and those of germanium accounting for 83 percent, according to Bloomberg.

Some in the West have been increasingly unsettled about the issue in recent weeks — for instance, the Pentagon plans to issue a first-time contract to US or Canadian companies by year-end to recover gallium, and the US has also warned that domestic chip suppliers might feel the pain.

EU officials are scrambling to map the bloc’s exposure to Chinese supplies of germanium and gallium, and saying they are “scared” about the scope of the move, according to a South China Morning Post report citing people involved in the discussion.

“Measures such as export controls have been frequently used by European and US countries to crack down on others, but China also has the right to use controls based on its own interests,” Gao Lingyun, an expert at the Chinese Academy of Social Sciences in Beijing, told the Global Times on Monday.

Analysts also clarified that rather than “revenge” or interfering with the normal operation of the global value chain, China’s ultimate purpose is to seek a level playing field.

Chinese officials reiterated that the export controls don’t target any specific country, but are intended to protect China’s national security and interests.

Asked about the move at a regular press conference in early July, Mao Ning, a spokesperson for the Chinese Foreign Ministry, said that it is an international common practice for a country to implement export controls on relevant items in accordance with the law, and it does not target any specific country.

China has always been committed to maintaining the security and stability of the global production and supply chains, and has always implemented fair, reasonable and non-discriminatory export control measures, Mao said.

Concept shares related to germanium and gallium have posted gains in China following announcement over the export rules. On Monday, Yunnan Chihong Zinc & Germanium Co rose by 1.07 percent and Grinm Advanced Materials Co was up 0.53 percent.

After China imposed export controls on gallium and germanium, the global market for these industries started to adjust. Possible adjustments include rebuilding rare mineral sources and reconstructing rare metal production chains. However, these changes will take time, He Jun, a senior researcher of Anbound, an independent think tank, told the Global Times on Sunday.

Unlike resource extraction, foreign countries face more challenges in refining industries, as many rare metals are byproducts of metal smelting chains such as aluminum refining. Establishing standalone production chains could be costly and economically unviable, He noted.