In an unforeseen turn of events, the looming threat of tariffs is casting a long shadow over the American manufacturing and consumer sectors. A Bloomberg report on Saturday reveals that US President Donald Trump’s proposed steel tariffs, set to take effect in two weeks, are already sending ripples through the market. These buyers are witnessing a perplexing trend: US domestic steel prices are on the rise, making American-made metal “cost more than imports.”

Recently, not only Bloomberg but also some other media outlets have taken notice that steel prices in the US have risen since Trump became president. A Reuters report on February 24, citing data provider Fastmarkets, stated that hot rolled coil prices in the Midwest had climbed 20 percent in the month after Trump took office.

On February 10, Trump signed proclamations restoring a 25 percent import tariff on steel and raising the tariff on aluminum to 25 percent, with these measures set to take effect on March 12. In a subsequent report, Reuters noted that while the stated goal of the new tariffs is to aid struggling US metal producers, it will take time to reopen closed plants and build new ones to compensate for large amounts of imports. Consequently, the prices of industrial metals in the US extended gains on February 11, as “industry will struggle to source enough domestic material.”

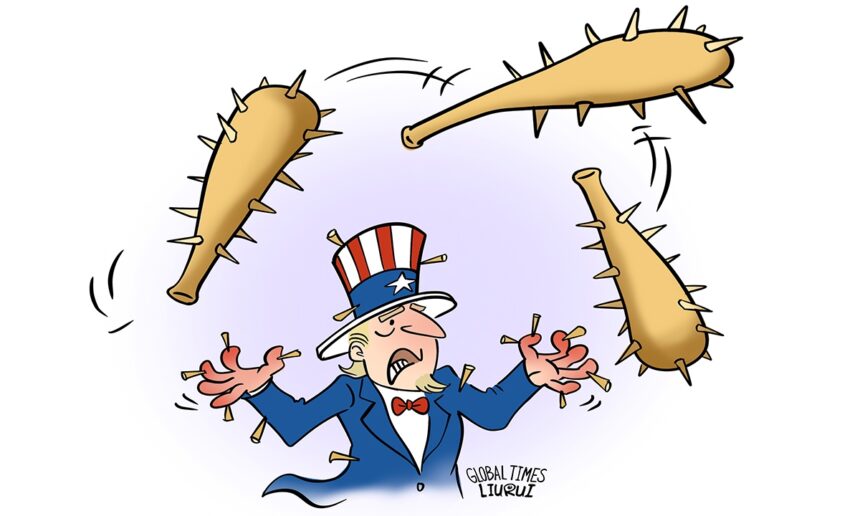

Will American metal producers capitalize on domestic shortages to hike prices and make a quick profit? If the answer is affirmative, it would be somewhat ironic, suggesting that the threat of tariffs has morphed into an opportunity for US steel and aluminum companies to profit at the expense of passing on increased costs to the broader manufacturing sector and consumers.

The rise in domestic steel prices in the US is putting pressure on downstream industries such as vehicles, construction and machinery manufacturing due to increased raw material costs. As steel is one of the fundamental raw materials for manufacturing and is widely used across various sectors, the chain impacts caused by rising steel prices could have multiple negative impacts on the overall US economy, including impairing industrial competitiveness and increasing economic operational costs.

Goldman Sachs expects the proposed 25 percent tariff on steel and aluminum to be largely passed on in US domestic prices, according to Reuters. The new tariffs would have a far-reaching impact on manufacturing costs and supply chains across a range of industries in the US, Boston Consulting Group said in analyzing the impacts of US tariffs on steel and aluminum.

From the perspective of US macroeconomic operations, the increase in steel prices can directly lead to higher production costs in industries such as infrastructure, vehicles, energy, machinery and home appliances, thereby squeezing profit margins for businesses. If companies are unable to absorb the rising costs and pass them on to consumers, this could drive up the prices of consumer goods, increasing the burden on American consumers and exacerbating inflationary pressures.

The latest proposed steel and aluminum tariffs, plus reciprocal tariffs, could boost the core personal consumption expenditures price index by an additional 0.4 percentage points, Deutsche Bank economists estimated in a February 10 research report, according to CBS News.

From the standpoint of US industrial development, rising steel prices elevate costs for downstream manufacturing, diminishing the price competitiveness of US manufactured products, and ultimately harming consumers’ interests. A high-cost environment could prompt companies to reduce investment and expansion plans, impacting the long-term development of the US manufacturing sector. This could inadvertently provide an opportunity for manufacturing industries in other countries to gain a relative competitive edge. However, this does not imply that the current developments in the US are beneficial to the economies of other countries. In fact, the threat of US tariffs is likely to disrupt the global steel and aluminum supply chains, causing negative repercussions for the global economy.

For nations within the global supply chain, a viable strategy to mitigate these negative impacts involves maintaining stability in their domestic metal prices amid rising costs in the US. By ensuring stable or even reducing domestic metal costs to widen the price differential with US metals, countries can bolster the development and competitiveness of their own steel and aluminum industries. This strategy could also invigorate the growth of downstream industrial sectors, offering a potential for economic growth in the face of global uncertainties provoked by US tariffs. In this endeavor, resisting trade protectionism, fostering fair competition on an international scale, and encouraging technological advancements emerge as critical components.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn