The Economic Times reported that the temporary relaxation of a safeguard mechanism stating a list of approved solar makers in March 2023 has ushered in a flood of cheap imports, forcing local manufacturers to idle some capacity.

With the implementation of the new policy, Indian manufacturers are expected to see a recovery, with sales and capacity expected to pick up, according to Indian media outlets.

Over the past few years, India has taken measures to cut imports of modules from China, and the ALMM is one of the measures. It is a sort of non-tariff barrier over and above the 40 percent basic customs duty on the import of modules.

Although India’s domestic PV industry has established its own industrial chain through a series of policy measures, with the growing market demand, the country’s manufacturing capacity is not able to meet its domestic and export demand, experts noted.

“India’s PV products rely heavily on imports from China, and related restrictions will harm India’s importers as well as the country’s green power industry,” Zhao Gancheng, a research fellow at the Shanghai Institute for International Studies, told the Global Times on Monday.

China’s PV exports to India in January-February 2023 were only $155 million, while in the first two months of this year, the figure was about $787 million, an increase of more than five times, according to news reports.

A staff member from a large domestic PV module producer told the Global Times that India is the world’s most promising market for the PV sector, but local trade barriers and risks also exist, and the entry into force of the postponed ALMM was also anticipated.

However, Chinese PV modules and cells will still occupy a large part of the market in India due to India’s lack of production capacity as well as the production and technological advantages of Chinese enterprises, the staff member noted.

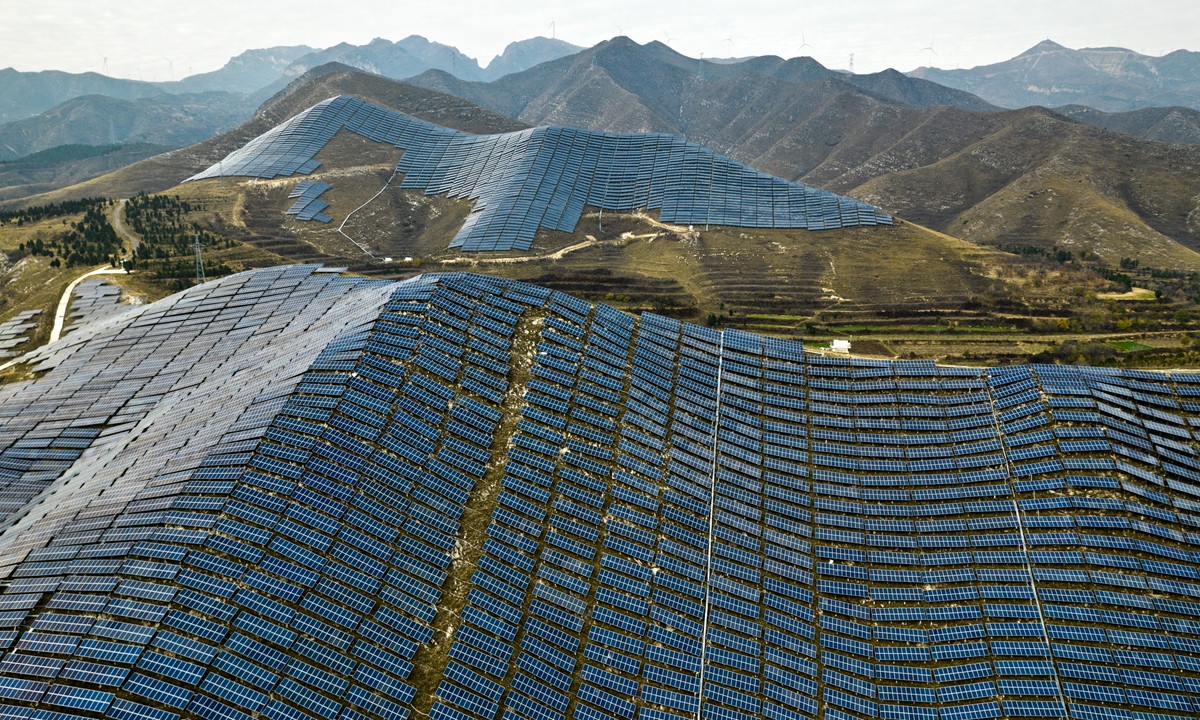

China is the world’s largest renewable energy market and equipment manufacturer, which stems from the country’s well-established manufacturing capabilities.

In terms of PV industry technology, China supplies more than 70 percent of the modules for the global market, and has set many new world records for cell conversion efficiency, occupying a dominant position in the world.

“India has always wanted to increase the proportion of ‘Made in India’ products in many areas such as solar power, but it often adopts distorting means that go against the laws of the market,” Qian Feng, director of the research department at the National Strategy Institute at Tsinghua University, told the Global Times on Monday.

Although India’s PV industry has made progress in recent years, it is not yet up to the level of Chinese enterprises.

ALMM and other measures may be able to support India’s domestic manufacturers in the short term, but in the medium and long run, it is not conducive to the improvement of India’s productivity and the realization of the goals of the clean energy sector, Qian noted.

“Since India came up with the concept of ‘Make in India,’ we haven’t actually seen a significant increase in its share of indigenous manufacturing,” said Qian.